My thesis is that corporate philanthropy can only be justified if it can generate increased value for shareholders, which is the sole mission of corporate officers.

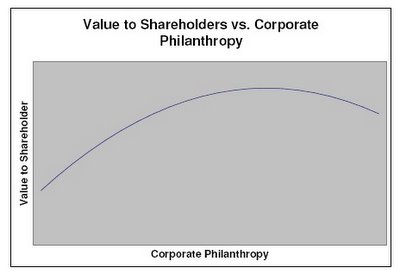

As the graph shows, some non-zero level of outlays in support of philanthropic causes will increase share holder value. However at some level, those outlays cease to increase value and become a waste of the shareholders money. Where this inflection point occurs will vary from firm to firm and perhaps industry to industry and can only be determined based on the individual executive's judgment. I hope to elaborate on the considerations of this process in future posts.

As the graph shows, some non-zero level of outlays in support of philanthropic causes will increase share holder value. However at some level, those outlays cease to increase value and become a waste of the shareholders money. Where this inflection point occurs will vary from firm to firm and perhaps industry to industry and can only be determined based on the individual executive's judgment. I hope to elaborate on the considerations of this process in future posts.

Nonetheless, at this point I will comment that philanthropy should not be used as a kind of insurance policy. Corporate philanthropy should be used in cases where corporate and philanthropic objectives align, not to curry favor with the public in the event of a scandal. The best insurance policy against a scandal are strong internal accounting controls and a culture that promotes ethical business dealings.